Typically, the leasing company and the dealer are not the same entity rather, the dealer acts an agent for the leasing company.

The "lease" is a legal agreement between you and the leasing company, specifying the terms and conditions for leasing a specific vehicle. The explanations below may make you more comfortable with the subject.

#LEASE RESIDUAL VALUE HOW TO#

He has written hundreds of articles on the subject of car buying and taught thousands of car shoppers how to get the best deals.There are many unfamiliar words you may encounter - may have already encountered - in discussing car leasing. After being ripped off on his first car purchase, he devoted several years to figuring out the best ways to avoid scams and negotiate the best car deals. Gregg Fidan is the founder of RealCarTips. (Absolutely NO SPAM, easy to unsubscribe)×

Here is a list of the top 40 cars with the best residual values. Only lease cars that hold their value well, or you'll be paying a lot more than you should. Hopefully, this opens your eyes and shows you why you need to pay attention to the residual value of the car you're thinking about leasing. The depreciation cost on the Saab is $489 per month compared to $387 per month on the G37. The Saab 9-3 on the other hand, has a residual value of only 39%. The Infiniti has a high residual value and is expected to retain 62% of it's MSRP value after 36 months. The reason it works out this way is due to the residual values of these particular vehicles. When you account for the MSRP price difference, leasing an Infiniti G37 versus a Saab 9-3 will save you over $2,000 and allow you to drive a car worth $8,000 more - unbelievable! That comes out to a savings of over $2,000 after 36 months.

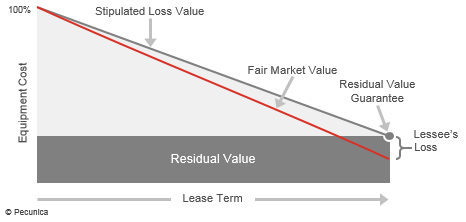

You would actually save $58 per month if you were to lese the Infiniti. These figures are based on a 6% finance charge and a 7% sales tax rate.VehicleMSRPLease TermResidual ValueDepreciationLease Payment 2011 Infiniti G37 Coupe$36,65036 Months$22,723$13,927$5722011 Saab 9-3 Sedan$28,90036 Months$11,271$17,629$630 To show you how important residual values are, let's take look at a real life example of how you can lease a $36,650 Infiniti G37 Coupe and pay a lower lease payment than if you leased a Saab 9-3, which is a vehicle that costs almost $8,000 less. If cars didn't depreciate, a typical lease payment on a $20,000 car would only be about $100 per month. In fact, depreciation cost makes up the bulk of your monthly lease payment. Unlike renting a house or apartment, cars lose their value while you drive them, and so you need to pay the cost of this depreciation as part of your lease.

Leasing a car is similar to renting a car on a long-term basis. (Residual value refers to the value of the vehicle at the end of the lease). What most people don't realize is how residual values affect the price of your monthly lease payments. It's amazing how many people lease cars without having a clue as to how it works.Įveryone focuses on low monthly payments and assume they're getting a good deal. TABLE OF CONTENTSGuideCar Leasing Why Residual Values Are So Important When Leasing a Car

0 kommentar(er)

0 kommentar(er)